Home Buyer is King!

October 09, 2017

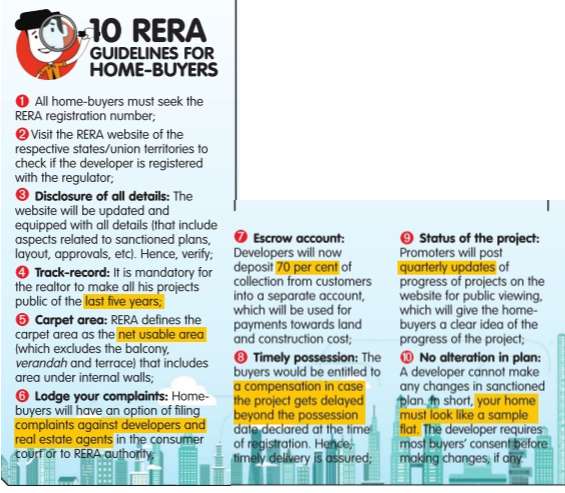

Are you well-versed with the new reformatory policies that have come into force? If not, here is a checklist that could help you seal the deal

Kirti and Ayush Rathod booked a 2-BHK flat in 2009 in a plush locale. However, their possession was deferred thrice. As a result, they not only had to pay the EMI (read: since they had taken a loan), but also bear the brunt of delayed possession by paying the rent. This is not a case study in isolation. Such cases have been aplenty in the past.

Source : epaperbeta.timesofindia.com

However, the situation is a tad bit different now. Revolutionary policy reforms like Real Estate (Regulation & Development) Act (RERA) and GST are now acting as a shield for the home-buyers against erring developers. Nevertheless, experts feel that home-buyers must know how to avail their rights.

Source : epaperbeta.timesofindia.com

GST BOOS FORT HOME-BUYERS

- A complex tax structure will be replaced by a unified 18 per cent slab

- There are no other taxes like VAT or service tax

- As developers will get input credit, it must be passed on to the buyers

- GST in all probability should not have an impact on the stamp duty charges

- While construction materials are placed in 28 per cent slab, residential projects under Pradhan Mantri Awos Yojna IPMAY) have been exempted from this slab

- GST rate on under-construction properties is fixed at 12 per cent

- Completed and ready-to-move-in properties a e of the GST purview

To Know about Real Estate Projects in ThaneContact Us at 022 2580 6868

Source: epaperbeta.timesofindia.com