Booking a Flat Being Built also Earns Tax Relief On Earlier Sale

December 23, 2017

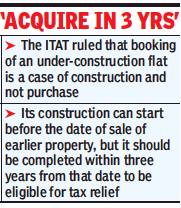

Mumbai: A taxpayer who books an under-construction flat and acquires it within three years of the sale of his old house will be entitled to a tax deduction, the Mumbai bench of the Income-tax Appellate Tribunal (ITAT) has ruled.

“Booking of a flat in an apartment under construction must be viewed as a method of constructing residential tenements,” said the December 18 judgment.

This ruling is important as tax relief on long-term capital gains (LTCG) accrued from sale of a house can be availed only if it is invested in another house within a specified period.

Under section 54 of the I-T Act, the period prescribed for investing the LTCGs in a new house is two years from the date of sale of the old house. The tax benefit is also available if a new residential house is constructed by the taxpayer within three years from the date of sale of the old house.

In this case, the taxpayer invested LTCGs of Rs 78.4 lakh arising from the sale of his share of a Byculla flat into booking a flat in an under-construction building at Mumbai Central. He paid the builder Rs 1.04 crore in instalments prior and post the sale of the old flat.

Read all Thane Real Estate Latest News

To Buy Spacious Flats in Thane Contact Us at 022 2580 6868

Source: epaper.timesgroup.com